Social security claiming strategies for married couples calculator

An ebook short for electronic book also known as an e-book or eBook is a book publication made available in digital form consisting of text images or both readable on the flat-panel display of computers or other electronic devices. Key Takeaways Claiming the standard deduction is easier because you dont have to keep track of expenses.

2

Automatically create the four most common alternatives for married couples.

. The Social Security Trustees annual report estimates that taxes on Social Security will total 451 billion in 2022 up from 345 billion in 2021. The Smiths can take the child tax credit of 4000 2000 per kid. This article concerns proposals to change the Social Security system in the United StatesSocial Security is a social insurance program officially called Old-age Survivors and Disability Insurance OASDI in reference to its three components.

Here are some top strategies for withdrawing your retirement funds from three planning experts. File and suspend was a Social Security claiming strategy that allowed couples of retirement age to receive spousal benefits while delaying retirement credits. They conclude that gains from delaying are greatest.

Although sometimes defined as an electronic version of a printed book some e-books exist without a printed equivalent. 2056 of the credit is a non-refundable credit that offsets the income tax liability and they are also allowed to take 1944 as a refundable credit. When figuring out your best Social Security claiming strategy your marital status is a good place to start.

Software to help you optimize your clients Social Security claiming strategy and increase their retirement value. Maternity refers to the period after the birth and is. There used to be a strategy for married couples called file and suspend where one spouse would file but immediately suspend their benefits which allowed the other spouse to file for spousal benefitsHowever this strategy is no longer available.

My wife and I were approaching our wedding day when I got the. See what other benefits you may qualify for. A one-time death payment of 255 can also be.

The standard deduction is 12550 for single taxpayers 18800 if youre a head of household 25100 for married taxpayers and slightly more if youre over 65. Due to Social Security laws that were passed in November 2015 anyone who suspends benefits after April 30 2016 will. Note that the claiming strategy called file and suspend which allowed married couples who have reached their FRA to receive spousal benefits and delayed retirement credits at the same time.

If you are married you need to use a retirement calculator for married couples or a retirement calculator for couples. When interest rates are low. Find out what options are available to married couples if applicable.

If your foreign tax credit is more than 300 for a single filer 600 for married couples filing jointly you will have to prepare Form 1116 to get the credit. See our advice and guidance on marriage and civil partnership discrimination. Widest split both at full retirement age both in January of their full retirement age and both at age 70.

Pregnancy is the condition of being pregnant or expecting a baby. For instance a spouse might go ahead and start claiming spousal. 7 min read Sep 06 2022.

Select your status to learn more about your Social Security options. More Canada Pension Plan CPP Definition. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and government contracting professionals.

A comprehensive 2012 study by economists John Shoven of Stanford University and Sita Slavov of Occidental College identifies the conditions when it is most advantageous to delay Social Security benefits. If they qualify your ex-spouse spouse or child may receive a monthly payment of up to one-half of your retirement benefit amount. Youre married and file jointly with a modified AGI of 105000 or less Youre a qualified widower with a modified AGI of 105000 or less Married couples who file separately would not be eligible for a full deduction though they may be able to claim a partial deduction for traditional IRA contributions.

The other expert notes the benefits of married couples being strategic about when to claim but its particularly smart for the higher-earning spouse to wait to claim until 70Take a man who gets 2600 a month or 31200 a year in Social Security income at full retirement age of 66 while his lower-earning spouse gets 1800 a month or 21600 a year claiming at the. The downside to the tax credit is that additional paperwork is required. View Alternate Social Security Strategies.

It is primarily funded through a dedicated payroll taxDuring 2015 total benefits of 897 billion were paid out versus 920. Civil partners must not be treated less favourably than married couples except where permitted by the Equality Act. There is a limit to the amount we can pay your family.

Heres How I Created 11 Income Streams and Bulletproofed My Finances. For married couples relative to singles. There are a variety of Social Security claiming strategies for spouses that maximize your benefits but it is unlikely that you are both starting at the same time not are you likely receiving the same benefit amounts.

If you are eligible to receive your own retirement benefit based on your own earnings record you will receive the higher benefit amount. These Social Security payments to family members will not decrease the amount of your retirement benefit. Ive never been married.

Several years ago there were a few spousal benefit loopholes that allowed married couples to maximize their Social Security spousal benefits. We would like to show you a description here but the site wont allow us. This form can be complex to complete depending on how many foreign tax credits you are claiming more on this.

Married couples can increase the Social Security benefit the surviving spouse will receive by having the higher earner delay claiming Social Security. Skip advert There are ways you can lower. I Endured a Tech Layoff Twice.

A married couple with two children will owe 2056 income tax on 43550 of adjusted gross income.

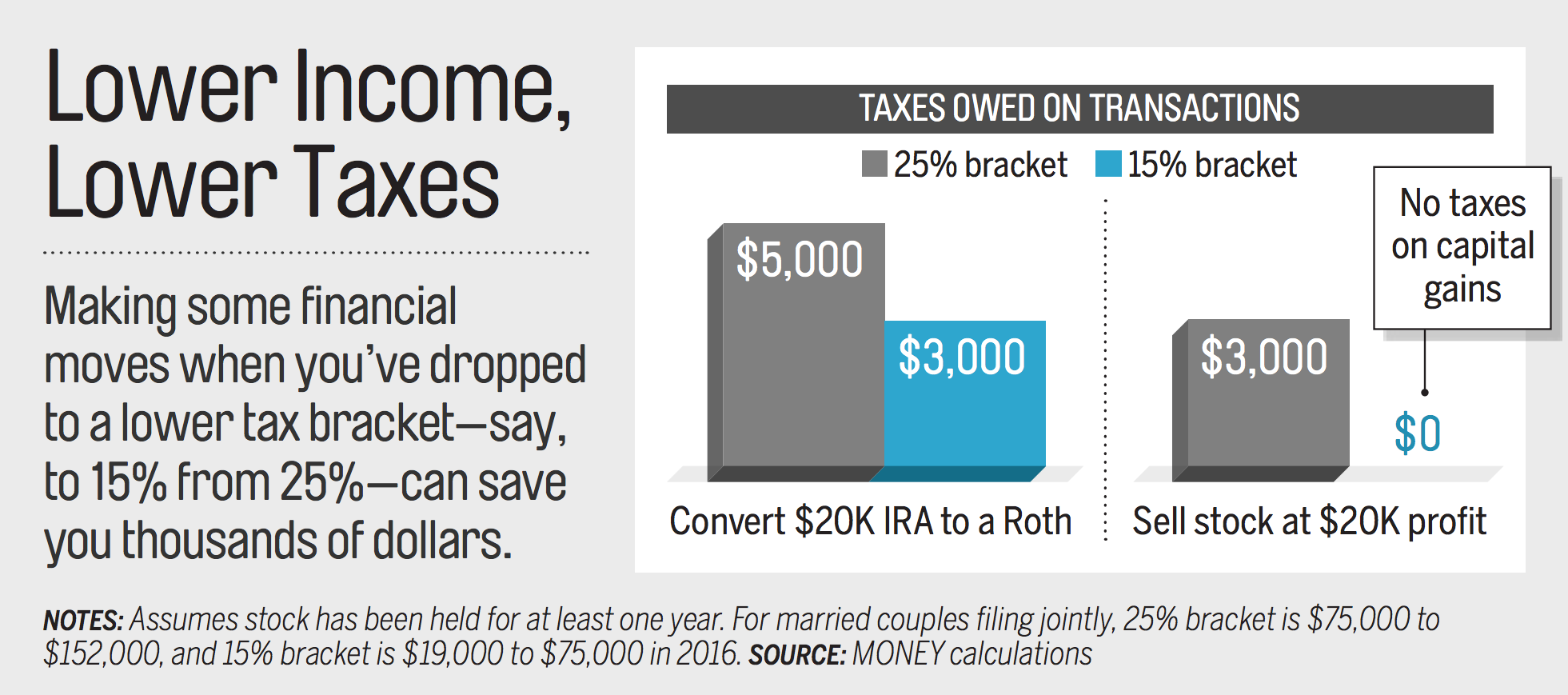

3 Ways To Lower Your Taxes In Retirement Money

Estate Planning For People With Disabilities Ppt Download

Social Security Tips For Married Couples Vanguard

2

Social Security Tips For Married Couples Vanguard

Social Security Tips For Married Couples Vanguard

Social Security With You Through Life S Journey Ppt Download

Social Security Tips For Married Couples Vanguard

Social Security Tips For Married Couples Vanguard

2021 Year End Tax Planning For Individuals Somerset Cpas And Advisors

Retirement Calculator For Couples Married Or Not Retirement Calculator Retirement Retirement Planner

Optimal Claiming Of Social Security Benefits The Journal Of Retirement

Social Security Analysis

2021 Year End Tax Planning For Individuals Somerset Cpas And Advisors

How Many Tax Allowances Should I Claim Community Tax

Social Security Tips For Married Couples Vanguard

2